Current ‘Digital’ Money

As much as many people use banking apps and send money via their smartphones, money isn’t really digital yet.

What do I mean by ‘not digital’? Of course it doesn’t mean you need to physically transfer paper money and metal coins to buy a coffee. You can of course do this digitally on your phone.

The digital experience today is mostly a UX layer of digitisation over legacy underlying systems. Think about sending money from your home country to a friend or relative abroad. You open your mobile banking app, enter their bank IBAN number, a few other details along with the amount and currency and that’s it!

Seems great? Not really. Nothing has actually happened apart from you gave an instruction to your bank move an amount X from bank A to bank B. The transaction was really an *instruction* with no guarantee to be carried out in any particular timeframe or even to be carried out at all.

The other major difference to real digital money is that without a bank account tied to your phone you simply can’t transfer money. I can’t send money to a vending machine for example without the machine being owned by a company that runs a bank account on behalf of the machine.

This doesn’t mean that digital money isn’t coming soon. Just recently a major report was released produced by six Central Banks (The Bank of Canada, European Central Bank, Bank of Japan, Sveriges Riksbank, Swiss National Bank, Bank of England, Board of Governors of the Federal Reserve and Bank for International Settlements) that discusses the key requirements of a true digital currency issued by Central Banks.

Just recently PayPal have also announced support for Cryptocurrencies with native support on their platform.

Real Digital Money

What I call real digital money doesn’t need a bank account, it just needs a wallet to store the digital currency. The account number is the wallet address.

Of course this is how cryptocurrencies work using the blockchain, but digital currencies don’t have to use blockchains. They could also be run by a Central Bank and issued or redeemed 1:1 for the national currency. Think of a Euro and a Digital Euro both of equal value but one is way more flexible than the other.

Digital currencies issued by a Central Bank would allow direct payments to be made from Governments to citizens without going through the traditional banking system. This would also make it much easier to include the entire population since only a smartphone would be required, not only those with bank accounts.

When you send money digitally the money is actually transmitted in real time, not just a promise to do so at some point in the future. It’s funny to think that in the year 2020 you can’t settle payments out of banking hours, on weekends or on public holidays 🤯

Money is just ones and zeroes

Money as Data

To my mind one of the biggest advantages is that money can finally be transmitted and processed just like data or any other digital information. This also means it can be programmed and automated and no longer needs to have a separate flow from the rest of you processes.

Your data flow and your payment flow can be combined.

What do I mean by that?

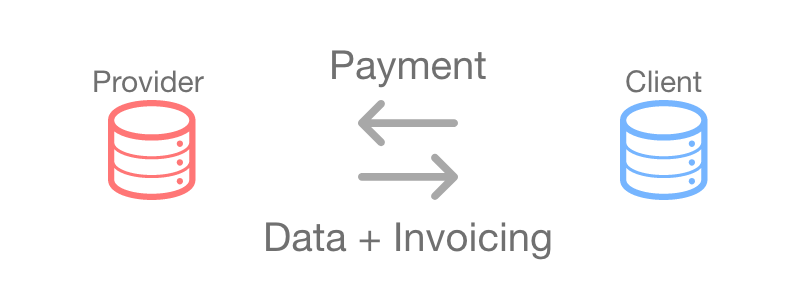

Imagine you have a process where you extract some data for a client, process the data in some way and write the data back to some destination. Classic ETL stuff. Image also that you invoice the customer based on the volume of work done.

The machine to machine economy or M2M will also allow IoT to better fulfil its promise where remote sensors can measure but also make and receive payments.

As it stands today you would make the process for the data and in parallel make some reporting on the process itself so you can send the details to finance every month in order to create an invoice for the service provided.

The analytical process may write some data to a database every second and the payment flow starts by aggregating the data on a monthly basis to see how much work you did last month.

But there’s no reason why in future the process can’t also invoice itself and receive payment itself. It’s just another (or the same) interface into the clients systems, request payment along with an itemised invoice of the work done.

The customers system could validate the invoice versus the work done and make the payment automatically. Testing the payment process would just be another part of the implementation of the ‘normal’ data process.

You have a full audit of the transaction, get payment immediately and avoid involving finance at all after the initial set up. No need to reconcile payments weeks or months after the actual work was done.

- Vending machines ordering exact stock levels from vending services in order to be filled up, selecting different suppliers based on most competitive prices.

- Your retail POS could order and make payment on new stock when stock levels drop below a predetermined levels.

- A delivery drone could pay a number of last mile delivery drones based on best price / speed / payload size etc.

- Cars could invoice you based on the actual distance driven so car leasing agreements could work more like care sharing apps

- Your laptop / phone could connect to WiFi routers around it and pay for Internet access. If paid by byte then it could automatically connect to multiple providers at the same time to improve speed.

- APIs that you use today but are billed by subscription every month or year could be truly pay as you use with billing an integral part of the API

While other areas of tech have raced ahead money is still very much stuck in the 1970’s. Yes we have nice apps and user interfaces but the fundamentals underneath all this are largely unchanged. This will inevitably change in the coming years and digital currencies will play a large part in this.